canadian tax strategies for high income earners

Anyone can contribute to a Roth 401k if available regardless of income level. In contrast only individuals earning less than 144000 in 2022214000 for married couplescan contribute to a Roth IRA.

HDI is one of North Americas largest suppliers of specialty building products to fabricators home centers and professionals dealers servicing the repair and remodel residential and commercial construction end-markets.

. Set your child or beneficiary up for success. Tax noncompliance informally tax avoision is a range of activities that are unfavorable to a governments tax system. Hardwoods Distribution Inc.

However geography lifestyle and spending habits each play a role in how far a 100000 salary goes. Learn about the tax-planning life cycle and how taxes can affect every stage of your investing journey. Urine at that time was collected and used as a source of ammonia for tanning hides and laundering garments.

Transactions - mid-market deals up to 250m Tier 1 In addition to handling acquisitions exits and investments in the private equity space Macfarlanes LLP advises clients on matters including equity incentive plans related to transactions private investments in public equity and carve. HDI or the Company today announced financial results for the three and six months ended June 30 2022. Being well-informed about certain tax topics can have an impact on your after-tax wealth.

Countries around the world usually implement one of four types of tax systems when it comes to taxable income. For the first time feminist staff were able to organize to identify issues and agendas. The Canadian Dutch and Nordic donor agencies made early advances in this field.

Withdraw at beneficiaries tax bracket. This account is the first step that customers can take towards becoming financially responsible as well as independent. Key players in some donor agencies tried to initiate changes to encourage development planners to rethink development policy and planning with women in mind.

The table illustrates that high-income earners gain more by investing in tax-exempt bonds than lower-income earners. Access a market thats much larger in scope than the Canadian stock market. In other words if you spend more than the allotted 183 days in Country XYZ your worldwide income will be taxed.

Canadians see owning a home as key to building their future and joining the middle class. This 2166 billion company is enduring as its the largest electricity transmission and. The three estate planning strategies that can benefit from low interest rates.

The general rule of thumb with the residential system is 183 days. This may include tax avoidance which is tax reduction by legal means and tax evasion which is the criminal non-payment of tax liabilities. Enjoy high liquidity and low transaction fees.

7 The number of words in Atlas Shrugged is 645000. S can still be a great toolespecially for high-wage earners andor those who anticipate higher taxes in. 10 There are several types.

Roth Options for High Earners. The Bible has about 700000 words. Its most general use describes non.

Roman emperor Vespasian placed a tax on urine in the 1st century AD. Macfarlanes LLP The Legal 500 Rankings Corporate and commercial Private equity. Revenues and net income increased 68 and 71 versus Q2 2022.

Find personal finance mortgage investment ideas. Gated Content Top Canadian Airline Stocks to Watch for 2022. Nedbank4me Account.

But with rent increasing and housing prices continuing to rise too many young people donât see a clear path to affording the same lives their parents had. The use of the term noncompliance is used differently by different authors. Globe Investor offers the most current and up-to-date information on stocks and markets from The Globe and Mail.

Zero taxation residential taxation citizenship-based taxation or territorial taxation. No income limits. Extra incentives for lower income earners.

A family or single person wont accumulate massive wealth on this wage alone but with proper saving and investing strategies one can stretch 100000 a long way. It is designed for customers up to the age of 18 and it is a savings vehicle which can be used to save pocket money money which is gifted or money earned from part time work. The number of words in the Federal Tax Code.

Enjoy tax deferred income. Comparatively speaking in the US 100000 a year is a great salary.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How To Pay Less Tax In Canada 2022 30 Practical Tips

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Personal Income Tax Brackets Ontario 2020 Md Tax

High Income Earners Need Specialized Advice Investment Executive

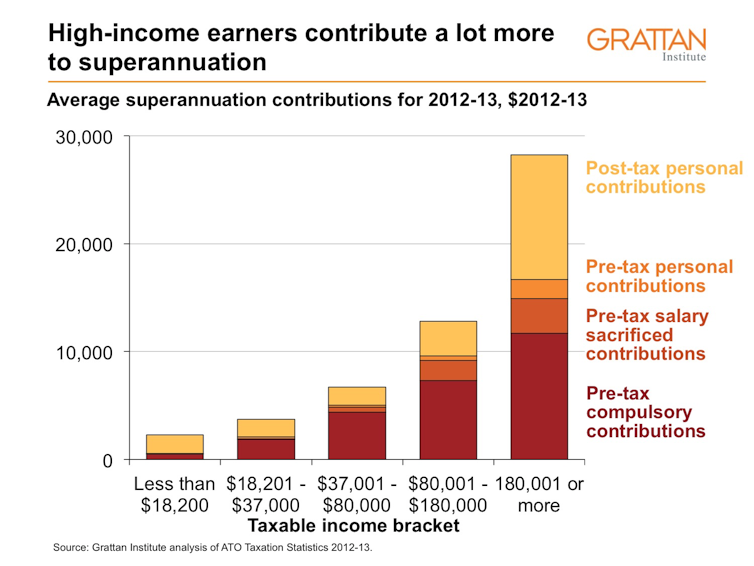

Catch Up Super Contributions A Tax Break For Rich Old Men